michigan use tax license

It normally takes 2-3 business days before MI state issues a sales tax license. If you are new to MTO start by creating a personal user profile.

This process is easy fast secure and convenient.

. Sales tax of 6 on their retail sales must be remitted to the State of Michigan. This process is easy fast secure and convenient. Begin at Michigan Treasury Online MTO.

Complete Treasurys registration application. Pre-Application Requirements Obtain a Federal Employer Identification Number FEIN Obtain Special Licenses 3. A business making sales at fewer than 3 events in Michigan should instead file the Concessionaires Sales Tax Return and Payment Form 2271.

Quickly Apply Online Now. The state sales tax rate is 6. Tax Manager Software Track federal state and local tax registrations and exemptions Store payroll sales and corporate income tax accounts Readily access tax identification numbers and key information Learn More.

However there are 10 states that will not accept an out-of-state resale. An online application is completed to the Michigan Department of Revenue web-site to get sales and use tax permit MI. In the state of Michigan it is formally referred to as a sales tax license.

Click here to discover how MTO works by watching a tutorial. Please reference the Tobacco Tax License Application Instructions for a checklist of required documents for each license type. Failure to do so can lead to penalties and interest charges.

Ad Apply For Your Michigan Sellers Permit. After completing this online application you will receive a confirmation number of your electronic submission. Exempt transactions include the following.

If you have any additional questions regarding the application process please contact the Tobacco Tax Unit at 517 636-4630 or treas_tobaccotaxesmichigangov. Ad Sale Tax Apply Wholesale License Reseller Permit Businesses Registration. An online application is completed to the Michigan Department of Revenue web-site to get sales and use tax permit MI.

At month end prepare Michigan sales and use tax report and forward to the Financial Operations by the 8th calendar day of the following month Appendix B. This certificate is invalid unless all four sections are completed by the purchaser. Can I Use My Michigan Wholesale License Out-of-State.

DO NOT send to the Department of Treasury. Determine whether the transaction is subject to Michigan sales or use tax. How do you register for a sales tax permit in Michigan.

The University has a Michigan sales tax license that is maintained by the Tax Department and renewed annually. You can receive your new Sales Tax License in. This registration will also allow a business to register for their Employer Account Number.

Alternatively taxpayers or a power of attorney can request a copy of a sales tax license by calling the Registration Unit at 517-636-6925. Click here to watch a tutorial. Sales and use tax in Michigan is administered by the Michigan Department of Treasury.

This e-Registration process is much faster than registering by mail. In addition retailers must be licensed to collect tax from their customers and remit the sales tax to the State of Michigan. Complete in Just 3 Steps.

Yes you can use your Michigan wholesale license in most other states to obtain a sales tax exemption on your inventory items. Taxpayers can print their current sales tax license from MTO with Registration access. Register online at the Michigan Department of Treasurys Michigan Business One Stop Website.

You will arrive at the MTO homepage. All claims are subject to audit. If so collect tax by.

You can receive your new Sales Tax License in as little as 7 business days. Any sales tax collected from customers belongs to the state of Michigan not you. Get Your Michigan Sales Tax License Online You can easily acquire your Michigan Sales Tax License online using the Michigan Business One Stop website.

What sales are exempt from tax. Application Submission Requirements 4. Helpful Resources Sales and Use Tax Information for Remote Sellers.

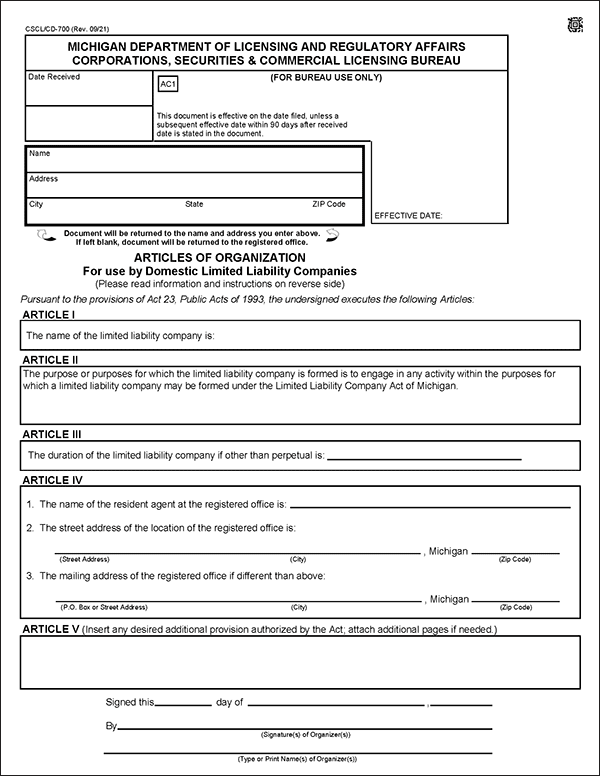

Allow 7-10 days for mailing. A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518. For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595a.

Steps for filling out the Michigan Sales and Use Tax Certificate Exemption Form 3372 Step 1 Begin by downloading the Michigan Resale Certificate Form 3372 Step 2 Indicate whether the transaction is a one-time purchase or a blanket certificate. If you elect to pay use tax on receipts from the rental or lease you must first obtain a Use Tax Registration before you acquire the property. The employer identification number is required to.

TYPE OF PURCHASE A. Retailers - Retailers make sales to the final consumer. It normally takes 2-3 business days before MI state issues a sales tax license.

Get Your Michigan Sellers Permit for Only 6995. Sale Tax Apply Simple Online Application. Michigan Resellers License Michigan Sales and Use Tax Certificate of Exemption.

Direct collection from customer or. The sales and use tax rate in Michigan is 6. It is essential to know that obtaining this license is one of the first steps a business owner should take when starting a business.

The e-Registration process is much faster than registering by mail. Resale Certificate in MI. Sales Use Tax Licensure This section applies to businesses that are applying for a license in Michigan for the first time.

Its your responsibility to manage the taxes you collect to remain in compliance with state and local laws. This license will furnish a business with a unique Michigan sales tax number otherwise referred to as a Michigan Tax ID number. Log in to MTO using your username and password.

Showing the tax on the invoice form 5078. The employer identification number is required to. Please contact us in the event you need a copy.

According to the state of Michigan anybody who sells tangible personal property in the state needs to register for a sales tax permit. It is the Purchasers responsibility to ensure the eligibility of the exemption being claimed. Do I need a sales tax license.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied transactions. After completing the online application you will receive a confirmation number of your electronic submission. Certificate must be retained in the sellers records.

If you have quetions about the online permit application process you can contact the Department of Treasury via the sales tax permit hotline 517 636-6925 or by checking the permit info website. Michigan Sales and Use Tax Certificate of Exemption INSTRUCTIONS. As of October 1 2015 out-of-state sellers with a sales tax nexus in the stateas defined by the General Sales Tax Act MCL 20552b and Use Tax Act MCL 20595aare also required to apply for a sellers permit in Michigan.

How To Get A Business License In Michigan Forbes Advisor

How To Register For A Sales Tax Permit In Michigan Taxvalet

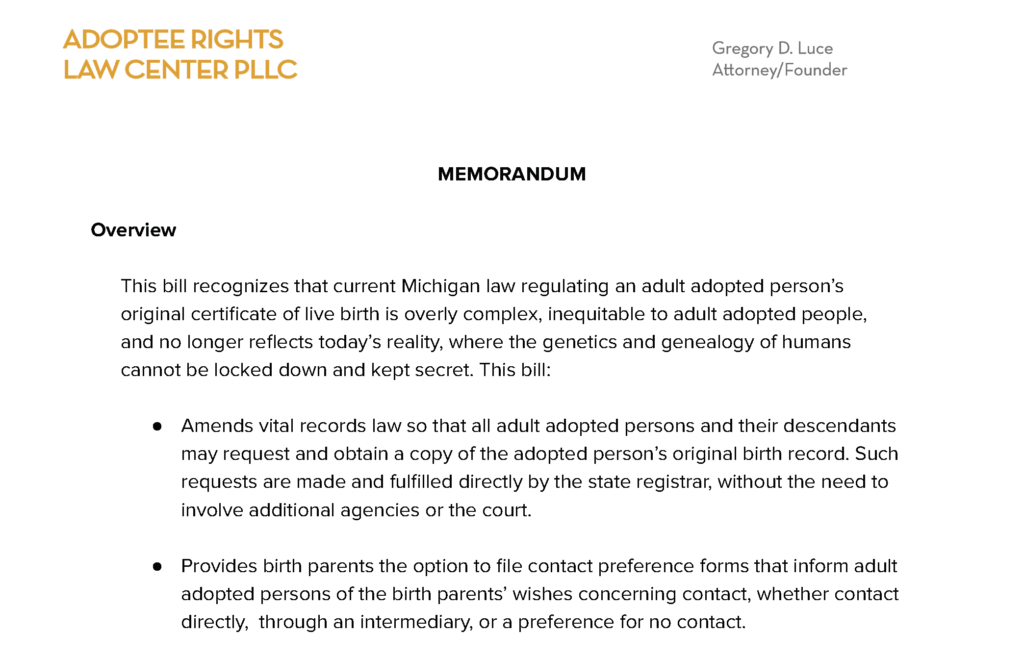

Michigan Original Birth Certificates Adoptee Rights Law

Instructions On Obtaining A Resale Certificate Sales Tax License

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Getting Familiar With Michigan Treasury Online Mto

How To Register For A Sales Tax Permit In Michigan Taxvalet

Michigan Sales Tax Small Business Guide Truic

Free Michigan Bill Of Sale Form Pdf Word Legaltemplates

Getting Familiar With Michigan Treasury Online Mto

State Of Michigan Taxes H R Block

Getting Familiar With Michigan Treasury Online Mto

How To Register For A Sales Tax Permit In Michigan Taxvalet

Michigan Sales And Use Tax Certificate Of Exemption